글 수 645,063

In a nutshell, your own credit report entails your current financial situation and debt quantity. Typically, you'll be eligible for a standard checking account when you've got a fantastic credit history. Nonetheless, you may have to consider other options when you've got a poor history. A history of a checking account with another financial institution would not influence your application. When you have an overdraft, defaulting are a promise that it might appear in your accounts. But in the event the financial institution turns the bill to a collection agency, the overdraft might seem. That said, you'll find restricted scenarios when this accounts can drop your score. Some banks can check your credit report before approving your application for a checking account. The inquiry or application to get overdraft protection could generally tank your credit score.

Dependent on the FCRA's provisions, it is possible to retrieve and dispute any negative information on your report. Mostly, if the credit bureau can't confirm the information, it has to delete it. Credit information facilities make lots of mistakes -- making such mistakes highly prevalent. A close examination of American consumers shows that about 20 percent of them have errors in their reports. Because your score is dependent on your report, a lousy report could damage your score seriously. Your score dictates your own creditworthiness in almost any credit card application of traditional loans. Several loan applicants have had an ineffective application due to a low credit score. It's essential to focus on removing the negative entries from the report keeping this factor in mind. From delinquencies to bankruptcies, compensated collections, and queries, such components can impact you. Since damaging items can affect you badly, you need to work on eliminating them from your report. One of the methods that operate with maximum efficacy is using a credit repair business to delete the items. Several consumers opt to use a repair business when they realize they can't go through all hoops. Because credit repair can be an overwhelming process, we've compiled everything you want to know here.

The FCRA explicitly claims that you can dispute any negative item on a credit report. The credit reporting agency is bound to delete a disputed thing that's shown to be illegitimate. Like any other thing, credit data centers tend toward making a great deal of mistakes, especially in a credit report. The FCRA reports that roughly 1 in every 5 Americans (20%) have errors in their credit reports. Ever since your report goes hand in hand with your score, a lousy report could severely damage your score. Because your score informs the kind of customer you are, you need to place heavy emphasis on it. Most loan issuers turn down programs since the customers have a poor or no credit score report. It is vital to work on removing the negative entries from the report maintaining this factor in mind. Late payments, bankruptcies, hard questions, paid collections, and fraudulent activity can affect you. Since damaging things can impact you severely, you should work on removing them from the report. You can eliminate the negative items on your own or involve a credit repair firm. Several consumers opt to utilize a repair company when they realize they can not go through all hoops. If you liked this short article and you would certainly like to receive more facts relating to Credit Card Tips kindly browse through our own web site. To ensure you go through all the steps with ease, we've compiled everything you want to know here.

The FCRA explicitly claims that you can dispute any negative item on a credit report. The credit reporting agency is bound to delete a disputed thing that's shown to be illegitimate. Like any other thing, credit data centers tend toward making a great deal of mistakes, especially in a credit report. The FCRA reports that roughly 1 in every 5 Americans (20%) have errors in their credit reports. Ever since your report goes hand in hand with your score, a lousy report could severely damage your score. Because your score informs the kind of customer you are, you need to place heavy emphasis on it. Most loan issuers turn down programs since the customers have a poor or no credit score report. It is vital to work on removing the negative entries from the report maintaining this factor in mind. Late payments, bankruptcies, hard questions, paid collections, and fraudulent activity can affect you. Since damaging things can impact you severely, you should work on removing them from the report. You can eliminate the negative items on your own or involve a credit repair firm. Several consumers opt to utilize a repair company when they realize they can not go through all hoops. If you liked this short article and you would certainly like to receive more facts relating to Credit Card Tips kindly browse through our own web site. To ensure you go through all the steps with ease, we've compiled everything you want to know here.

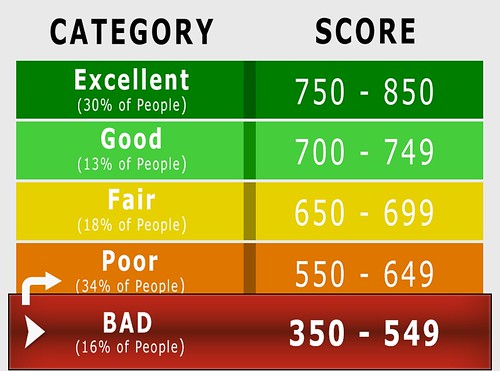

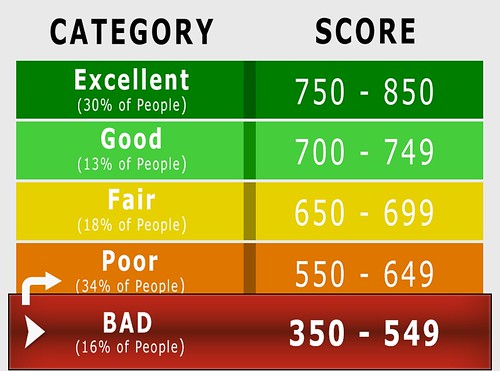

Potential lenders do not check your whole credit report; they use your score to judge you. Various loan issuers utilize customer-specific models to look at their customers' credit reports. Likewise, credit card businesses use various approaches to check their consumer credit reports. If you have poor credit, loan issuers are far less likely approve your application. In rare scenarios, your program would be successful, but you'll incur costly fees. Therefore, keeping an eye on your finances would help keep you on top of your financing. Among the methods for monitoring your financing, checking your credit rating regularly would assist you. The 3 data centers provide a free credit report to consumers every year. After retrieving your report, you need to examine the things that severely damage your own credit report. Before focusing on complex items, begin with focusing on straightforward elements. There are many repair companies; hence you should select your desired one wisely. Ideally, assessing your credit report regularly would help you handle your finances well.

Potential lenders do not check your whole credit report; they use your score to judge you. Various loan issuers utilize customer-specific models to look at their customers' credit reports. Likewise, credit card businesses use various approaches to check their consumer credit reports. If you have poor credit, loan issuers are far less likely approve your application. In rare scenarios, your program would be successful, but you'll incur costly fees. Therefore, keeping an eye on your finances would help keep you on top of your financing. Among the methods for monitoring your financing, checking your credit rating regularly would assist you. The 3 data centers provide a free credit report to consumers every year. After retrieving your report, you need to examine the things that severely damage your own credit report. Before focusing on complex items, begin with focusing on straightforward elements. There are many repair companies; hence you should select your desired one wisely. Ideally, assessing your credit report regularly would help you handle your finances well.

There are many credit repair firms in this particular landscape. Thinking about the vast number of testimonials on the internet, finding the ideal one can be difficult. For nearly everyone, credit fix could be the therapy that they desired. Within this digitized age, you are able to search the world wide web to obtain the perfect repair choices you have. In a glance, you'll observe that picking from the countless repair businesses on the web can be hard. Besides, Credit Card Tips you wouldn't want to invest your cash on a repair firm with no substantial track record. Having helped many people solve their credit difficulties, Lexington Law is a remarkably reputable firm. While being in business doesn't mean a company is good enough, Lexington has over that to offer you. Lexington Law is famous for being compliant with exceptionally high Federal Standards. Moreover, Lexington law always maintains an impeccable success speed during recent years. Among the best credit repair companies, Lexington Law is certainly worth your consideration.

Dependent on the FCRA's provisions, it is possible to retrieve and dispute any negative information on your report. Mostly, if the credit bureau can't confirm the information, it has to delete it. Credit information facilities make lots of mistakes -- making such mistakes highly prevalent. A close examination of American consumers shows that about 20 percent of them have errors in their reports. Because your score is dependent on your report, a lousy report could damage your score seriously. Your score dictates your own creditworthiness in almost any credit card application of traditional loans. Several loan applicants have had an ineffective application due to a low credit score. It's essential to focus on removing the negative entries from the report keeping this factor in mind. From delinquencies to bankruptcies, compensated collections, and queries, such components can impact you. Since damaging items can affect you badly, you need to work on eliminating them from your report. One of the methods that operate with maximum efficacy is using a credit repair business to delete the items. Several consumers opt to use a repair business when they realize they can't go through all hoops. Because credit repair can be an overwhelming process, we've compiled everything you want to know here.

The FCRA explicitly claims that you can dispute any negative item on a credit report. The credit reporting agency is bound to delete a disputed thing that's shown to be illegitimate. Like any other thing, credit data centers tend toward making a great deal of mistakes, especially in a credit report. The FCRA reports that roughly 1 in every 5 Americans (20%) have errors in their credit reports. Ever since your report goes hand in hand with your score, a lousy report could severely damage your score. Because your score informs the kind of customer you are, you need to place heavy emphasis on it. Most loan issuers turn down programs since the customers have a poor or no credit score report. It is vital to work on removing the negative entries from the report maintaining this factor in mind. Late payments, bankruptcies, hard questions, paid collections, and fraudulent activity can affect you. Since damaging things can impact you severely, you should work on removing them from the report. You can eliminate the negative items on your own or involve a credit repair firm. Several consumers opt to utilize a repair company when they realize they can not go through all hoops. If you liked this short article and you would certainly like to receive more facts relating to Credit Card Tips kindly browse through our own web site. To ensure you go through all the steps with ease, we've compiled everything you want to know here.

The FCRA explicitly claims that you can dispute any negative item on a credit report. The credit reporting agency is bound to delete a disputed thing that's shown to be illegitimate. Like any other thing, credit data centers tend toward making a great deal of mistakes, especially in a credit report. The FCRA reports that roughly 1 in every 5 Americans (20%) have errors in their credit reports. Ever since your report goes hand in hand with your score, a lousy report could severely damage your score. Because your score informs the kind of customer you are, you need to place heavy emphasis on it. Most loan issuers turn down programs since the customers have a poor or no credit score report. It is vital to work on removing the negative entries from the report maintaining this factor in mind. Late payments, bankruptcies, hard questions, paid collections, and fraudulent activity can affect you. Since damaging things can impact you severely, you should work on removing them from the report. You can eliminate the negative items on your own or involve a credit repair firm. Several consumers opt to utilize a repair company when they realize they can not go through all hoops. If you liked this short article and you would certainly like to receive more facts relating to Credit Card Tips kindly browse through our own web site. To ensure you go through all the steps with ease, we've compiled everything you want to know here. Potential lenders do not check your whole credit report; they use your score to judge you. Various loan issuers utilize customer-specific models to look at their customers' credit reports. Likewise, credit card businesses use various approaches to check their consumer credit reports. If you have poor credit, loan issuers are far less likely approve your application. In rare scenarios, your program would be successful, but you'll incur costly fees. Therefore, keeping an eye on your finances would help keep you on top of your financing. Among the methods for monitoring your financing, checking your credit rating regularly would assist you. The 3 data centers provide a free credit report to consumers every year. After retrieving your report, you need to examine the things that severely damage your own credit report. Before focusing on complex items, begin with focusing on straightforward elements. There are many repair companies; hence you should select your desired one wisely. Ideally, assessing your credit report regularly would help you handle your finances well.

Potential lenders do not check your whole credit report; they use your score to judge you. Various loan issuers utilize customer-specific models to look at their customers' credit reports. Likewise, credit card businesses use various approaches to check their consumer credit reports. If you have poor credit, loan issuers are far less likely approve your application. In rare scenarios, your program would be successful, but you'll incur costly fees. Therefore, keeping an eye on your finances would help keep you on top of your financing. Among the methods for monitoring your financing, checking your credit rating regularly would assist you. The 3 data centers provide a free credit report to consumers every year. After retrieving your report, you need to examine the things that severely damage your own credit report. Before focusing on complex items, begin with focusing on straightforward elements. There are many repair companies; hence you should select your desired one wisely. Ideally, assessing your credit report regularly would help you handle your finances well.There are many credit repair firms in this particular landscape. Thinking about the vast number of testimonials on the internet, finding the ideal one can be difficult. For nearly everyone, credit fix could be the therapy that they desired. Within this digitized age, you are able to search the world wide web to obtain the perfect repair choices you have. In a glance, you'll observe that picking from the countless repair businesses on the web can be hard. Besides, Credit Card Tips you wouldn't want to invest your cash on a repair firm with no substantial track record. Having helped many people solve their credit difficulties, Lexington Law is a remarkably reputable firm. While being in business doesn't mean a company is good enough, Lexington has over that to offer you. Lexington Law is famous for being compliant with exceptionally high Federal Standards. Moreover, Lexington law always maintains an impeccable success speed during recent years. Among the best credit repair companies, Lexington Law is certainly worth your consideration.